Time is running out: Close before December 31st 2021 for Potentially Significant Tax Savings

You may remember the article we published back in January, “Tax Implications of Selling Your Business in 2021 vs. 2022.” While the potential tax changes are still unknown, we have seen many funeral home owners take a proactive approach and sell their business in 2021. This has allowed them to transition to a new stage of life with more free time and less stress. In fact, the NewBridge Group has never been busier in our 24 years doing this work with the highest number of funeral home transactions in the first half of 2021 than in all previous years.

Fast forward to now and time is running out to be able to close before the end of 2021. The clock is ticking, but the silver lining is that there is still a small window of time to make this important decision. The NewBridge Group would urge those considering a sale before the end of the year to reach out to us before the end of September to allow all parties enough time to properly complete a sale.

“While the decision to sell a business should never be predicated on taxes alone, the potential for higher tax rates is a consideration, especially among business owners planning to retire in the next few years.” according to the recent article by Forbes – https://www.forbes.com/sites/rcarson/2021/07/26/is-this-the-right-time-to-sell-your-business/?sh=435302e724de

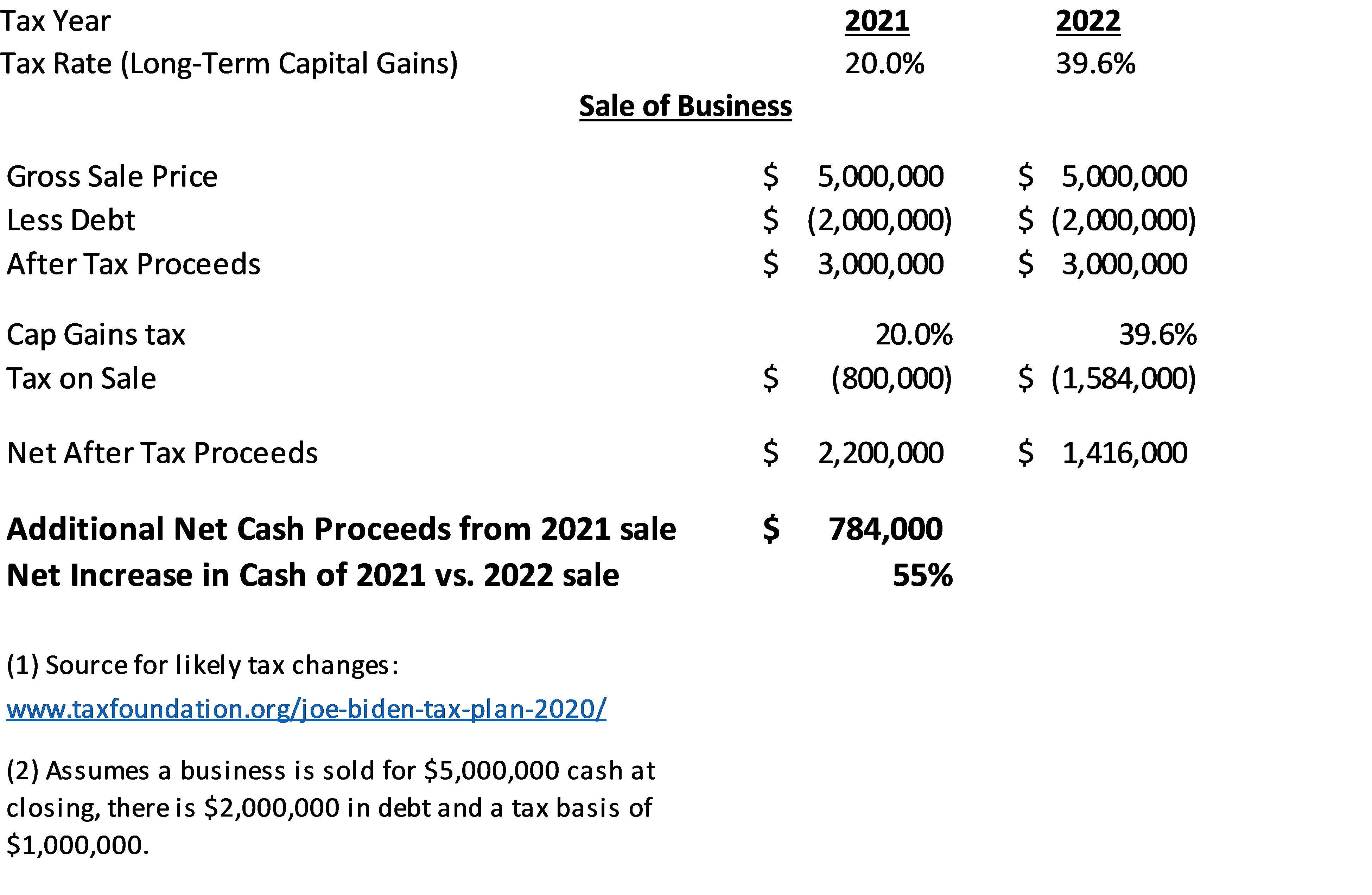

The following is an excerpt of our article from January that details the potential tax implications:

Below is a chart of the current long-term capital gains tax rate compared to the Biden tax plan. The consensus is that these rates will not be retroactive, but rather will be voted on and set into place starting January 1, 2022 or soon thereafter.

In a 2018 study by SmallBusinessTrends.com(3) 41% of business owners planned to sell over the next 5 years. With many owners deciding to sell this year, buyers are inundated with opportunities to purchase creating a backlog so transactions will be more difficult to close before year end. Given this scenario, requesting your complimentary valuation, and reviewing your options to make an informed decision is a wise choice for any funeral home owners thinking about their exit strategy.

To complete a sale before December 31, we advise being under a signed Letter of Intent by at the latest October. This means you should start the process as soon as possible. If you are interested in exploring a sale of your business, call us directly at 813-579-7048.

(3) https://smallbiztrends.com/2018/02/business-exit-strategy.html